Commentary: Ginko Financial is Either Fraudulently or Negligently Managed

July 28th, 2007 by Benjamin Duranske

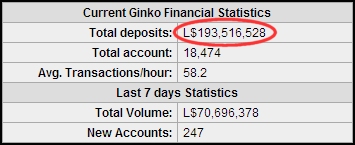

I’ve been capturing data off of Ginko’s website the last two days, and the numbers do not lie. I am convinced that Ginko Financial is a fraud or is negligently managed. The proof is a little complex, but if you are a Ginko investor, reading this is absolutely worth your time.

At 6:00 PM SLT yesterday, Ginko claimed that it had L$192,378,551 in “Total Deposits.” Three hours later — after a day during which Ginko head ‘Nicholas Portocarrero’ said a “bank run,” occurred — Ginko reported L$194,462,018 in deposits. That means Ginko wants you to believe that its total deposits increased by L$2,100,000 (about US$8000) during the three hours between 6 PM and 9 PM yesterday.  That is smack in the middle of the time that most Ginko depositors were actually withdrawing money in a what ‘Portocarrero’ described as a “panic.”

That is smack in the middle of the time that most Ginko depositors were actually withdrawing money in a what ‘Portocarrero’ described as a “panic.”

Ginko reported an average of about 59 transactions per hour during this time. That is 177 transactions. So Ginko is asking you to believe that 177 people walked up to Ginko’s ATMs between 6 and 9 PM, in the middle of a bank run, and collectively increased Ginko’s deposit total by 2,100,000 Lindens.

Were you one of those people? Did you deposit a huge amount of money? Do you know anyone who did? Do you know a single person in your whole life who is so stupid that they would have deposited USD $8000 with Ginko last night without making it a loan against some collateral?

I just do not believe it, and if you are a rational person you should not either. My guess is that these 177 people actually took out as much as they could. I was standing around Ginko ATMs talking to people a lot yesterday, and everyone was bitter that they couldn’t withdraw any money. When they were final able to, they took everything they could, and then they kept trying. 177 transactions at the L$5000 limit Ginko imposed all day should have set Ginko back about L$850,000, not netted it L$2,100,000.

But most lies have a small kernel of truth, and that kernel of truth usually helps explain them. Here’s my best guess as to what that kernel of truth is here. Ginko managed to borrow some money against its current assets. That’s what ‘Portocarrero’ told Reuters he was going to try to do (“I’m looking to borrow short term cash using [Ginko assets] as collateral”), so it makes perfect sense that that’s what happened.

I’ll even guess the number. It was $L3,000,000. That covers the roughly L$850,000 that the 177 people who made transactions took, and it accounts for the extra L$2,100,000 that now sits like a big fat stinking lie in Ginko’s “Deposits” column.

And here’s the problem — that’s fraud if they realize what they’re doing, and shockingly negligent if they don’t.

If the L$3,000,000 was an investment against a current asset, it cannot be counted as a “deposit.” I know this is complex, but it’s absolutely correct, and it is incredibly dangerous accounting, for Ginko investors. If they guaranteed that $L3,000,000 loan by promising to give the guy that loaned it to them something else they already owned (a car, part of a second life business, etc.) in the event that they couldn’t pay it back, then it is not a new asset, and it absolutely can not be used to increase the “Total Deposits” number.

If I am right, it means that the number on Ginko’s website for “Total Deposits” can’t be trusted. And if that number can’t be trusted, then none of the numbers there can — and it is only a matter of time before a bank run like today’s is too big for Ginko to get out from under by borrowing more money.

This might still work out okay, for a while. If enough people have abandoned Second Life and left some cash with Ginko, it could easily have enough to weather this storm. If they’re able to keep borrowing against assets and calling the money “deposits,” they can even make things look good.

But if I am right, then it is only a matter of time before that’s not true anymore. You can’t report investments in your company as part of “Total Deposits” and not expect to run out of money pretty quickly, because you are essentially counting one asset as “income” twice. If I am right, it means that the giant number on Ginko’s website — 193 million Linden in total deposits right now, or around three-quarters of a million U.S. dollars — is a farce. And if you have money in Ginko, that better worry you.

For what it’s worth, as of 9:00 AM SLT today, about half of that mysterious “new deposit” money is gone, and withdrawals are still severely limited.

[Update: Ginko has changed the daily withdrawal limit several times, ranging from 5k to 25k, over the last two days. For the most recent limit, check Ginko's website. Note that you cannot see the changes as the old limits are taken off when new ones are put up.]

Related Posts on Virtually Blind

- Ginko Financial Suspends then Limits Withdrawals; Head ‘Nicholas Portocarrero’ Calls it a “Bank Run,” Tells Depositors to “Calm Down”: "One of Second Life's high-interest, self-styled "banks," Ginko..." (10 comments)

- Ginko Financial Selling Server on eBay: " According to the official site, Second Life's Ginko Financial is..." (5 comments)

- Commentary: Ginko Bank Run Update – Day Four: "VB's primary coverage of the Ginko Financial bank run can be found in..." (5 comments)

41 Responses to “Commentary: Ginko Financial is Either Fraudulently or Negligently Managed”

Leave a Reply

Notes on Comments: Your first comment must be manually approved, but after it is you'll be able to post freely with the same name and email. You can use some HTML (<a> <b> <i> <blockquote> etc.) but know that VB's spam blocker holds posts with five or more <a> links. VB supports gravatars. Got a gravatar? Use the associated email and it'll show with your comment. Need one? Set it up for free here.

It’s been ages since I’ve been to their site but are you sure that your reading that correctly, it could be that the deposits column as they’re putting it out (and if I’m right that’s still pretty fishy) is just that deposits without taking withdrawals into account, if that’s true then even if the withdrawals were two or three times what the deposits were then it would show up with that much in deposits. That would also be a pretty crude and dishonest (in my opinion) way to hide how much money he’s actually losing to this “bank run”.

Well done for outing Ginko! You’ll make an investigative journalist yet ;-)

Good question, Gordon. It has to reflect the claimed current total of all Ginko accounts rather than just claimed deposits, because it sometimes drops (it dropped over two million Linden yesterday morning). You’re right that it’s dishonest, but it’s dishonest in a more complex way.

Thanks, Ashcroft. Funny thing is that investigative journalism was what I originally planned to do for a living, before law school distracted me. I suppose that’s what one’s “Second Life” is for. I call it the 3D internet, or an advanced communications client, or whatever, but I have to admit that I’m finding it totally immersive, in my own way.

I don’t know if this will make much difference in the long run, but people who search for Ginko on the internet need to be able to find some facts about what they’re doing. It is obviously possible to make money with them in the short run, and we don’t know if the “short run” is two days, two weeks, two months or even two years, but I am certain that this accounting discrepancy is a very good indicator of how they are fooling investors, and perhaps even themselves.

Update: at approximately 2:30 PM SLT Ginko’s “Total Deposits,” after having dropped all day steadily, jumped again to last night’s level in, apparently, a single transaction of approximately L$1,000,000. I defy anyone to tell me with a straight face that someone just gave Ginko over US$3700 on today, of all days, without collateralizing that loan.

So now, just in the past 18 hours, I’ve seen L$4,000,000 (over US$15,000) of Ginko’s “Total Deposits” come in this way.

I do not believe for one second these are standard deposits and not secured loans, like Nicholas said he was seeking just yesterday. And if they are loans, then Ginko’s management has absolutely no business telling the investing public that they are deposits. The move makes it look like all of today’s and yesterday’s withdrawals have been offset by an equivalent amount in deposits, and anyone who is thinking about this has to realize that simply cannot be true.

I think there is a possiblity that Nicholas personally borrowed money from someone and deposited it into Ginko by using his alt or somebody else.

Shiela6225 Allen – that’s an interesting theory. If it’s true (and without something more concrete, I don’t see any reason to believe he did this, but anything is possible) it definitely would show at least some dedication to the thing in a captain of the sinking ship sort of way.

Of course, if Nicholas is personally borrowing funds to cover withdrawals (rather than selling or borrowing against Ginko assets like he told Reuters he was going to do) that raises a whole bunch of really troubling questions.

The biggest one would be why he has to in the first place, since Ginko claims it has almost US $750,000 in deposits, at least *some* of which he ought to be able to liquidate. And the second biggest one would be whether he has been treating his assets and Ginko’s as if they were one and the same for a while.

Theres one thing that you didnt consider. The total deposits is a measure of Ginko’s liabilities, not directly the amount people put into it. All that interest that they pay out daily gets added to the liabilities. Every day that number should go up, even if nobody is depositing money.

Jamay – Thanks for the comment. I think you’re completely right about how they’re coming up with that number. But if the “total deposits” is the amount of money that Ginko owes depositors at any given time, they definitely can’t add to that number by borrowing money against those deposits.

Now, if what you’re saying is maybe the daily interest all hits at once, and that increases the total and explains the mystery “deposits” I’ve seen, that’s a good theory, but when you multiply it out, the daily interest number just isn’t big enough to explain the increase.

Right now, they say they’re paying 0.13% a day (that’s 13/100 of one percent). 13/100 of one percent of the total deposits comes to about $L250,000 per day, which is a big number, but it is a small part of the 4 million Linden in supposed “deposits” I’ve seen hit today.

I think it’s got to be loans, and including those as deposits is exactly what I am saying is negligent at best, and possibly fraudulent.

———————————————————————————————————

Incidentally, Jamay’s comment got me thinking. Ginko is supposedly paying L$250,000 in interest every day. That’s around US$1000 dollars a day, or about a third of a million US dollars a year (actually, it’s more, since it is compounded every day, but anyway, it’s a whole lot of money). Do you think Ginko Financial is making a thousand dollars a day, or a third of a million US dollars every year on its investments? It’s possible, I guess, but making a 50% profit year after year is pretty damn hard. I personally know a number of guys who do this for a living, and none of them come even close.

And that makes me think of another thing. Do the people who run Ginko ever admit that they take anything for all their hard work, generating these giant, stupendous, bigger-than-any-hedge-fund returns? If not, doesn’t that seem pretty fishy? I haven’t ever seen them say, “Hey folks, we’re decreasing the total deposits by five million Linden today because we’re paying our own salaries and paying Linden Lab for our sim.” And that makes me wonder, why not? Either they just do it for fun and are spending loads of their own money maintaining Ginko’s presence in Second Life, or they’re taking money out without telling anyone.

And since I don’t believe Nicholas, Hinoserm, and Dox (the guy who recently posts most frequently to the official Ginko blog) are doing this for fun, I’m starting to wonder… how much?

Don’t discount the possibility that a virtual “Mister Potter” offered Ginko a backroom bail-out deal. Watch the first half of “It’s a Wonderful Life” for a basic understanding of what a “bank run” is.

It’s quite conceiveable that a bailout was arranged that put several million more L$ into the bank to use as assets to pay withdrawals. It’s also very possible that such a injection of cash may have been tallied as a deposit.

Winter, you are right — that’s definitely possible. In fact, I’d say it’s certain. A “bailout” is pretty much what a big influx of cash to a failing bank amounts to, no matter what it’s called. (And I love “It’s a Wonderful Life.”)

So sure, somebody (or a couple somebodies) clearly really did give Ginko a total of around L$4m over the last 36 hours (I might have speculated that they just made it up, but people who couldn’t withdraw earlier were able to after it hit, so there really was a pile of money added).

The question here though is this: do you think Ginko’s “Mr. Potter” was making a loan, secured against Ginko assets, where he gets the asset, if Ginko ends up failing after all, or do you think he was just giving money to Ginko as a deposit, with no strings attached? And remember, Nicholas told Reuters that he was going to seek out short-term investors who would loan Ginko money against Ginko’s assets. (Another question entirely is why they need a loan or a bailout in the first place to cover withdrawals that have, so far, totaled well less than 4% of their “Total Deposits.”)

Me? I’m betting it was a secured loan (actually a couple of loans, given that the L$4m I’ve seen hit so far has come in two chunks of L$1m and L$3m) because, frankly, it’d be pretty stupid to give money to a failing bank without security.

And if so, it absolutely cannot be tallied as a deposit. That is fraud, (or, best case scenario, appalling negligence) and it is a huge red flag that should tell anyone who has money there to get it out whenever (if ever) they’re able to

You know, if you’re wondering about 0.13% interest rates generating $1,000 US a day – perhaps you should look at the banks where 0.15% and more are present interest rates.

Another question is, if they’re borrowing against their assets, then what the Dickens are their assets?

It is obviously some sort of script that automatically adjusts and displays data relating the Ginko holdings

i think SL banks are silly and i have no money with them, so in essence, i have no horse in this race…

however, my instinct tells me they secured the 3 million loan you assume, and added it to the pool of available funds so people can remove their money should they see fit

the script that tallies the data for display has no way to distinguish a cash infusion when the currency is added to the general pool to allow withdrawals to begin again

hence, i dont suspect this as manipulation of data of solvency as i dont believe the script was built to accommodate a cash infusion in an emergency situation… and essentially, your expose is more about a parameter not included/explained in the script that was built to allow transparency in transaction information

there may not be a way to throw 3 mil cash from a loan into circulation without the appearance of inflated numbers

after all, this is a script to help show activity to the general public, this is NOT a report to the SEC where every dime needs to be in the correct column

IMHO, this is just them trying to get cash into peoples hand so that they can fulfill their duties to those that gave money, during a time of crises, therefore keeping the company solvent with a good reputation without being destroyed by this weeks events, thus losing the remainder of the money people deposited

again, i think SL banking is silly, but after all this time, i have yet to see anything that makes me think ginko is a scam at all

the only thing that gives me pause is that outside of SL, nothing is known about them at all… that secrecy hardly inspires faith when money is concerned

but in my opinion, if ginko was indeed s scam, taking the money and running would be the most likely outcome and i dint think management would have put more of their own cash/assets in to keep things floating… this was the ideal time to close up shop if theft was the intention… the fact that they have somehow tapped their personal reserve to make sure people can withdrawal actually seems to make them more legit in my mind

as again, right now would have been the peak point in which to cash out and leave and prevented anyone from reclaiming their currency… and they seem to have done just the opposite… they somehow invested more to ensure that people could withdrawal cash

as you pointed out in the article, if they secured a loan for the 3 mil, they have put their own risk up… *not* residents money, to fulfill the obligation they promised

i could be wrong, but the circumstantial evidence, to me, seems to make them look more legit, not the opposite

Mulch, you know, I actually agree with a lot of that. The fact that they do appear to be trying to make this work at least in the short term, even now, does make it look like their hearts are in the right place (though I suspect they have spent some of the deposits, and I wonder how much, since they’re apparently taking out loans to cover them). That’s one of the reasons I’m open-minded about the possibility that this is just negligently managed, and not a scam. On the other hand, if something bad has happened (say, most of the money has just been spent) there would also be a real incentive to pay deposits and survive a bank run, because if they have spent the deposits, or been misreporting all along, when this collapses, there’s a pretty good chance somebody is going to track them down and serve a lawsuit. There could, conceivably, even be criminal charges for this kind of thing. It’s certainly happened many, many times before with too-good-to-be-true investments, albeit never before in a virtual world.

Also, it sounds like you’re saying that you don’t put any faith in that number, the three-quarters of a million USD that is listed as “Total Deposits.” I don’t either, obviously. That said, I’m not sure that saying, “Well, that’s just what they’re telling the pubic,” is really much of an excuse for artificially inflating it. That’s sort all the info they’re giving the public, and it’s pretty clearly designed to give the impression that people are dealing with a solid company. But sure, negligence in putting the script together makes as much sense to me outright fraud, at least without more information.

Nobody – I definitely do wonder about some of the other banks. I think they’re probably doing roughly the same thing, but at least for now, they aren’t subject to a run. I started paying attention to Ginko in February when a law journal concluded it was probably a ponzi scheme. I just happened to hit their page on the day this run started — actually, I was checking the story that gave a very publicly banned avatar their last lottery prize that day — and that’s how I ended up writing on it.

Update: as of 8:30 AM SLT, the L$4.2m I saw added over the last day and a half has been systematically withdrawn. No significant additions occurred overnight. Withdrawals are still capped, though they’re at 10k now (US $38), and still appear to be occurring at about the same rate (a half-million Lindens were taken between 2 and 9 AM SLT).

One interesting fact I haven’t hit here yet: two nights ago Ginko temporarily raised the cap to 25k for a few hours (they took that fact off their web site when they dropped it again) so investors who are trying to withdraw a lot of money may want to keep pretty close track of the limit.

Hey, it was not long ago when Luke from the WSE was telling people that he would buy out all the banks, even if they were Ponzi schemes, as to try and prop up the SL banking market. If you look at who owns the WSE and Hope Capital (you can see who owns the stock on their charts page on the WSE web site.), it is almost 50% owned (via funny stock) by the owner of Ginko. I wouldn’t be surprised if the Ginko guy went to Luke and said, “hey, lend me some cash to keep Ginko going because if it fails and the Ponzi is exposed, you’ll look bad also, and I’ll have to sell the Hope Capital stock which will make the stock price fall through the floor and make you look bad.”

And now, the WSE had the 3.2 million L$ stolen from it. And now, what do you know? The WSE is shut down and not trading again.

Look into it. All a little odd, huh? For all we know, Ginko and the WSE just move money around between each other to make it look like they have lots, when in reality, they, or at least Ginko may be on the edge of an all out collapse.

Look into it.

Update: I just watched today’s daily interest hit the “Total Deposits.” Damn it’s fun to have hard numbers on this operation to play with.

At 9:00 PM SLT (right at midnight, east coast USA time) the “total deposits” number started steadily increasing, and when it stopped, about two minutes later, it had increased by precisely $L250,004, which is exactly .0013 of the previous claimed total (Ginko’s daily interest rate is currently .13%).

So they’re counting interest as deposits too, which I’d figured, but now it’s confirmed.

We’re about to head into day four of the bank run, and they’re still letting people withdraw only US$38 a day each — and many people are reporting they can’t get even that much.

Also, statistics update, people managed to withdraw around 1.2 million Lindens from Ginko over the last 24 hours. That’s about half of yesterday, but since I personally couldn’t access my $L balance, use search, or teleport much of the day, I’m actually amazed that people manged to pull even that much out.

Finally, you all know I’m a pretty level guy most of the time, and try pretty hard to keep it impersonal at VB. But sometimes, I just can’t. So to people like this clown, who are encouraging depositors to keep their money in Ginko out of some sense of civic duty: shut your greedy, ignorant pie holes. It’s not monopoly money, it’s not Ginko’s money, and it’s most certainly not your money. It’s depositors’ money, and they can and should do what is right for them, individually, right now. Shame on you.

Depositors have every right to withdraw their money when they want to. If Ginko is frantically borrowing money now rather than selling assets (are there really any assets, Ginko?) then there is no reason to believe that depositors will be able to to get their money in the future. Suggesting that people wait and see what happens it is terrible, terrible advice. It might be good for Ginko, and it is probably really good for anybody who is advocating it (particularly if they’ve got a lot more than the current daily limit in Ginko) but it is NOT good for individual investors.

Since this offensive “Give for Ginko!” garbage is starting to float around, here’s my advice, particularly to small depositors: don’t listen to these cheerleaders. Get everything you can as fast as you can, and then keep trying. If Ginko bounces back, you can always put your money back in later. But if it doesn’t, then you won’t have lost everything.

And if you’re a big depositor, you’re going to be especially tempted to jump on the “Give for Ginko!” bandwagon, but don’t be that asshole. Take what you can, and if you lose some, take it like a grownup. You knew there was risk here, and getting something out of it is better than losing it all. Really, if they can’t cover you now — remember, they’re supposed to be able to sell the assets they supposedly bought with your big deposits — there’s no reason to believe they’ll be able to later.

[...] The guy who founded Ginko Financial, Nicholas Portocarrero, has never, as far as I could find, given his real name to anyone. And yet, if you believe the numbers on the site, and there is some speculation, he presumably holds as much as 192 million Lindens worth of other people’s money. But read what Benjamin Duranske says about Ginko’s numbers. I’ve got to agree with Mr. Duranske, I’m smelling something fishy here too. [...]

I guess I am what you might call a big depositor. I currently have 124,000 Lindens tied up in Ginko and have been forced to withdraw a paltry sum of 5-10K per day since the cap. At my present rate of withdrawls it will take almost a month to get it all out. I feel a bit like I’m in a race against the inevitable collapse of this “financial fraud.” But I will of course take it like a man whatever the outcome. I knew it was risky and I did enjoy a high daily interest for the last 6 months or so. But taking it like a man doesn’t mean curling up and taking it up the rear. If there is any legal action against these hooligans, I will certainly join in on the suit.

Thank you for an excellent read so far, this is informative and timely information.

Update: the grid is still down while they bang on things. I haven’t been able to see my Linden balance for almost a day, and I figure I’m not the only one.

This is kind of an interesting situation, because it has given Ginko a free day’s worth of time to convert assets to cash (if there are any assets to convert to cash) and borrow money, which might help.

On the other hand, depositors are probably going to hit it pretty hard when they’re finally able to, since the longer the downtime, the more people who hadn’t realized there was a run yet may pick up on the problem while killing time on news sites.

One other update this morning. Nobody Fugazi has a short, important piece up that shows a significant financial connection between WSE and Ginko.

http://www.your2ndplace.com/node/298

“big” – I know you mean the name ironically, but you’re being way too hard on yourself. I could not be more impressed with what you said, and with some real money on the line here, I really do wish you the best getting at it. If this does collapse, I would not be at all surprised to see a class action suit against these guys, if they’ve got anything left to get at. It makes me wish I was practicing at the moment.

Good luck today, everybody.

Well, this grid Denial of Service attack as covered by Tateru (http://www.secondlifeinsider.com/2007/07/30/what-is-wrong-with-the-sl-grid/ ) is pretty convenient for WSE and Ginko. Maybe this will give them the time they need to get themselves together.

However, if WSE is doing code testing with ATM’s, they’re hosed.

[...] VB’s primary coverage of the Ginko issue can be found in two posts below, but there a few important facts are worth highlighting today. [...]

[...] Commentary: Ginko Financial is Either a Fraud or Negligently Managed – Benjamin runs the numbers showing that Ginko almost certainly outright lied about its total deposits. [...]

You’ve got to be a fucking moron to invest in Ginko, seriously.

I am one of those unfortunate dudes who decided to stick with Ginko. I should’ve gone on the Bank run, as my total funds with them was somewhere around $75 bucks anyway. Instead, I just got shafted big-time. I have been promised “L$1 equivalent bonds” but I see none of that in my WSE account.

So sad.

Even sadder is that I actually work in a real bank, and well, high interest rates are usually something that raises red flags anywhere. I had not realized this until sometime around the time SL decided to ban casinos. I dismissed it argumenting “oh well, they’ve been able to keep it up, no problem there”.

Then the bank run came, and everything went titsup. Ow.

Common Sense – Maybe, in retrospect, but I do feel for people who listened to these people. It took me six months to prove to myself what was happening. A lot of smart people have fallen victim to scams. There’s good lessons in D. Hilbert’s post.

I’m sorry, Mr Duranske, but whilst it is true that a lot of “smart people” have fallen victim to scams, it tends to be down to greed overcoming any intelligence they may possess. This was always an obvious fraud from the day it arrived, promising immense profits for doing nothing at all, far above anything else, no details as to how these were obtained, no proof that the reserves existed to cover withdrawals, nothing, nothing, nothing… and yet they were feted, criticisms ignored.

Lo and behold, the whole thing falls apart – perhaps sooner than designed, due to attempted withdrawals by casino owners, but it would happen eventually – and there are handwringing posts as to the failures in the model, as if it wasn’t blatantly obvious from day one that this was a complete con job.

Ordinal – Yeah, I know. It still really sucks for them though. What’s amazing to me right now is that there are another 20 or so of these out there. All much smaller and younger, but they’re clearly doing the same thing.

In case anyone wants to find Mr. Nicks real name, you need look no further than the ginkofinancial.com and ginkosoft.com whois listing.

Apparently Mr. Nick hails from Rhode Island:

Michael Pratte

PO Box 282

Manville, Rhode Island 02838

He claims he is from south america to throw everyone off his trail.

He is in the process of making his whois info private so he can’t be found and the ginkosoft.com whois is now private, but was public until recently. And it matches the ginkofinancial.com record.

And how do I know that that is his real name? Well ginkosoft.com has been registered since 2000 which pre-dates second life.

Plus a subpoena to GoDaddy to get more of his personal information would reveal even more.

Or does someone have other information about who Michael Pratte is?

BTW, has anyone noticed how most of the scams that happen on Second Life have their websites hosted through GoDaddy? Makes you go hummmm. Could the same group or even the same person be behind it?

I’m letting the comment above run even though I, personally, haven’t printed this information before. I have actually had the info from GoDaddy for a while (it’s slightly more complex – if you just run a whois, you get GoDaddy, but if you run a whois via GoDaddy, you get the information above). About a half-dozen readers sent it to me over the last two weeks, and I’ve got a screenshot of it from back then, just in case. One reader even found a physical address for a Michael Pratte a few miles from the P.O. box, though if I’m right about at least one avatar of Michael Pratte, the guy moved to Texas since then (more below).

Why now? Well, I’m letting this run for a couple reasons. First, if the owner of the Ginko domains really is converting the domains to anonymous whois, then it is important to preserve the information. And second, the poster makes an excellent point re: year 2000 registration of one of the sites — a point that I had overlooked.

The reason I haven’t run this info on VB up to now is that I had — so far — been fairly convinced that the registrant, Michael Pratte, though affiliated with Ginko and someone who took money from it, was not the person who controls the ‘Nicholas Portocarrero’ avatar. I’ve known I could be wrong on this point, but I was never sufficiently convinced otherwise to run the data identifying Pratte.

That all said, I’m intrigued by the above poster’s (confirmed) point that ginkosoft.com was registered in 2000 (well before Second Life was created).

That has to mean either:

1) Andre Sanchez (who controls the avatar ‘Nicholas Portocarrero’) met a guy in Second Life in early 2005 who already had a domain. Under this theory, I’m guessing the guy is ‘Hinoserm Rebus,’ Ginko’s technical guy, and an avatar probably controlled by Michael Pratte. That guy — Pratte/’Rebus’ (or some other avatar we don’t know about) owned a website called “ginkosoft.com” already, and he and Sanchez decided to name the bank “Ginko” because the site wasn’t being used for anything. They then bought ginkofinancial.com (in 2005), and Pratte/’Rebus’ (or whoever) registered that one too.

or…

2) There is no “Andre Sanchez” and the guy who owns both domains — Michael Pratte — ran Ginko and controls both the ‘Portocarrero’ and ‘Rebus’ avatars.

If the second of the above options is true, and this whole story (Nicholas being inspired by a famous banker, etc.) is completely phony from the beginning, then it’d be pretty hard argue this wasn’t actually set up as a scam from day one.

Also, for what it’s worth, it would be a lot easier to sue a guy who is in the U.S. (if Pratte… is Hinoserm… is Nicholas — he is now in Texas according to the Official Ginko Blog) than a guy in Brazil.

I’m not really sold either way, but I’d love to hear what readers can dig up and extrapolate. To get you started, you can see how “Ginkosoft” used to look here, before they excluded it from the internet archive:

http://web.archive.org/web/*/http://www.ginkosoft.com

And of course, the first thing any lawyer who brings a suit here will do is subpoena the identities of both of them from Linden Lab.

[...] In the transcript below, we learn that Ginko has basically no money to pay depositors, that AVIX’s ‘Investor Allen’ claims he doesn’t think that a company promising 60% returns is paying old investors with new investors’ money, and (in answer to one of my questions, thank you very much) that ‘Nicholas Portocarrero’ is really a guy in Brazil named Andre. [Ed. Note: Or maybe not, there’s some reasonable debate about even that name, now.] [...]

You guys did not deep enough on the ginkosoft.com domain.

There is a tel. # listed in the GoDaddy whois.

According to Switchboard.com and Google it is listed to:

“Normand Lew

(401) 658-0784

3574 Mendon Rd, Cumberland, RI 02864

”

When you Google on that name, you will find:

http://www.manta.com/coms2/dnbcompany_82s87

“East West Marketing Inc

3574 Mendon Rd, Cumberland, RI 02864-2127, United States (Map) (Add Company Info)

Phone: (401) 658-0784″

and

”

Contact Name:Normand Lew

Contact Title:Partner”

Woah… and East West Marketing appears (at least by the link) to be a broker/dealer, bringing a whole gamut of securities law.

Allow me to add some additional information regarding some of the comments I’ve seen here:

1) Normand Lew on Mendon Rd is my uncle, with whom I have lived on and off for several years. Whilst you are free to call the number listed on my domain(s), don’t expect the messages to be relayed to me properly, as it requires two or three different people to get them to me.

2) My whois information has never been — nor never will — be made private. I do not trust handing over ownership or control of my domains to another party (which, as I understand, is the only way to make that information “private” without breaking several rules), reputable or otherwise. I also do not desire to hide my identity. If my whois information is being shown as private or 3rd party, please notify me immediately, as it is not authorized, and I will bring it to the attention of the registrar.

3) I own ginkofinancial.com (the domain), including all of the Ginko Financial software, equipment, and data stored upon said equipment. The understanding between me and Nicholas when I agreed to write and maintain the software for him is that all payment made to me would be for the limited license to use the name, software, and equipment — not for exclusive rights or ownership of them. It was also part of our understanding that I wouldn’t share information he gave to me during the design of the software unless I was told to do otherwise, and it was my request that he not tell me more than I absolutely needed to know to do my job, because frankly, it’s a bunch of mumbo-jumbo that I really don’t care about.

4) To those who question that Nicholas and I are seperate people, I find it intriguing and very enjoyable to watch your debates. It is interesting that people believe I could have single-handledly played the role of (what could ultimately amass to) several hundred different people, running what I have read here as “most of the scams that happen on Second Life”.

5) I am insulted that (else-article) I have been linked to “college students” of the same name as me — I do not have a complete high school education, let alone a collage education — and am fairly proud of the knowledge I’ve gained on my own.

Since this is the only article I’ve found so far that I’ve enjoyed reading (and partially because I spoke to Benjamin in SecondLife briefly and thought he was a cool guy), it will probably remain the only one I’ll be leaving comments on.

Feel free to copy, maim, fold, spindle, or multilate the above text to fit your particular side of any debate, story, etc. Be aware that I may do the same to any communications sent to me regarding these matters or this comment.

-Hinoserm Rebus (Michael Pratte)

Hinoserm – thanks for posting. If you don’t mind answering a few more questions, I’m really curious about a couple of things based on your note.

1) Have you, essentially, revoked the license for the software, etc. that you had given Nicholas?

2) How did you come to know Nicholas/Andre? Have you ever spoken to him directly? Are you still communicating with him?

Finally, since I know passions can run high on this issue, I want to say this: I appreciate the fact that Hinoserm is posting here, and if he’s willing to take questions in comments to this piece (I’m hopeful he will) I’ll thank everybody in advance for keeping the discourse as civil as it usually is on VB.

Ahh, I’m wounded Hinoserm. I never claimed you were the same person as Nicholas, and I’ve actually been nice in my writing of you. I never called you a college kid. Hmm. OK. I’m not wounded, but it certainly has a dramatic touch. I know why you really posted here, as do you.

That said, *thank you* for posting here, or anywhere for that matter. I can respect someone who stands up – that you are the only one who has done so convincingly. Would that this sort of post had been done months ago…

But as an autodidact – I am one as well – you must appreciate that this should be a learning experience for you. When you fail to disclose, you open yourself up to speculation.

To then complain of the speculation is folly.

Benjamin: I would be happy to.

1) Essentially, for the time being, yes. Technically, Nicholas does still have administrative access to Ginko Financial, although the dataset was corrupted when it was hurrily readied to move to WSE, so it doesn’t do much good; I would need to make several repairs before Ginko Financial (or at least it’s software) could be usable again. Ethical issues aside, there was some talk between us (me and Nicholas) to re-open Ginko Financial under the same management, possibly reintegrating old account/bond holders, or possibly starting from scratch. I don’t believe this is actually going to happen, however.

2) This is actually three questions, so I’ll break them into three different points;

A) Nicholas and I met back in Riiki (SecondLife region) way back when I was just starting in Second Life. My group (Ginko Technologies, then known as GinkoTech Engineering in SL) owned some land there, and we had built a skyscraper-type building for playing around with. Nicholas had flown over one day to look at it, and we started talking; apparently he had learned how to make clothing in SL, and I had commissioned a few things from him. One thing led to another, and he ended up renting one of the smaller parcels we had (though I don’t think he ever actually remembered to pay rent, which was fine) to play with SL’s building tools, and we just became friends over time.

B) I have never spoken to Nick outside of SL or AIM (AOL Instant Messager), which is about the same for most of my friends. Although I tried to get him into a voice chat once, he never wanted to, and to this day I still want to hear his voice.

C) We haven’t spoken much since the decision to close down Ginko Financial, though I wouldn’t say we’re on bad terms. Granted, I also wouldn’t say we’re on the best of terms; this whole ordeal has left me with alot of bills to pay and has left me again questioning my trust in people, but I still consider Nicholas a friend.

Nobody: I’m not sure I understand your comment. It’s not my intention to “fail to disclose”, nor have I “complained of the speculation”. If you have taken my comments to be sarcastic in manner, you’re mistaken. I have no problems with speculation or disclosure, and I’ll try to answer any questions I see fit for public knowledge. Speculation intrigues me, and it’s enjoyable to see what people can learn (or think they’ve learned) about me on their own.

-Hinoserm

Hinoserm – thanks for your response. Your response in 36, all numbers but particularly ’5′ which included the word ‘insulted’, seems to be a complaint w.r.t. speculation. You may say that you did not write it as such, but it easily reads as such.

The ‘speculation intrigues me’ bit is a bit much, but I’m glad you wrote your mind. For the record, I didn’t really see much point in speculating on you because it seemed apparent that you and Nicholas were separate for various reasons. It is good that you gained some enjoyment from people speculating on you, however I must submit to you that the speculation was probably not enjoyable for them. The ‘toying’ aspect of what you wrote – whether you meant it or not – comes across as derisive.

And just as this all died down, you posted a comment again. Now, to me, that is amusing.

So what is your next business, Hinoserm?

[...] wenn Bank draufsteht. Das mussten viele Nutzer der digitalen Welt Second Life schmerzlich erfahren: Gingko Financial, die bekannteste “Bank”, löste sich im September spurlos auf. 200 Millionen der [...]